Corporate Services is responsible for receipts and payments. Individuals and businesses who need to pay property taxes, utilities, permits and licenses, and accounts receivable can use the following methods. Apply for a tax certificate here.

| Questions? |

|---|

| Call 403-223-3541 Monday - Friday 8:00 am - 4:30 pm |

Expand the blue (+) tabs below to learn more.

Online

Online

Online

Experience the convenience of making secure online payments through OptionPay, a trusted payment gateway (service fees apply). Whether you're settling your property taxes, managing utility bills (including bulk water accounts), obtaining permits and licenses, or clearing accounts receivable, OptionPay simplifies the process.

Please note

Online payments require up to 24 business hours for processing, ensuring a seamless and efficient transaction experience. All transactions carried out through OptionPay follow a tiered fee schedule, starting at a minimum fee of $2.00.

In-person

In-person

Visit our office during our weekday hours of operation, Monday through Friday, from 8:00 am to 4:30 pm. You can choose to settle your property tax bill using cash, debit, or cheque.

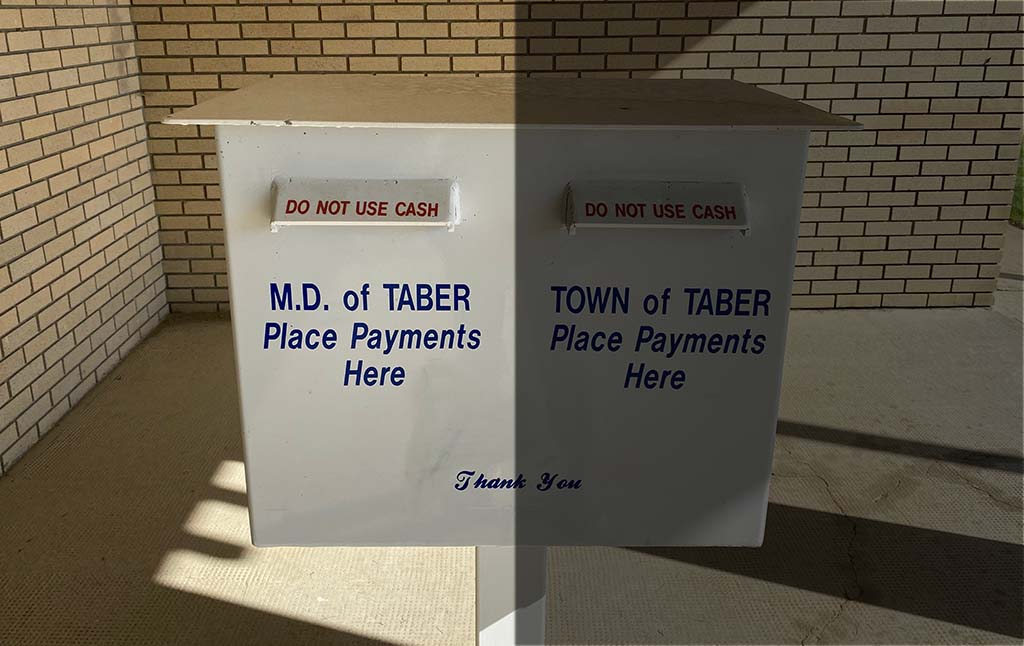

Alternatively, if you are unable to make it during our regular hours, feel free to drop off your payment via cheque in our secure after-hours drop box located at the front entrance. We strive to provide you with flexible and hassle-free payment methods for your convenience.

By mail

By mail

Send a cheque addressed to:

Municipal District of Taber

4900B – 50th Street

Taber, AB T1G 1T2

Do not send cash by mail!

The Municipal District of Taber gladly accepts postdated cheques as a safe and reliable payment method. To ensure your property tax payments are processed without any penalties, kindly ensure they are received at our Administration Office or dispatched via Canada Post with a postmark no later than September 15th.

At most financial institutions

At most financial institutions

To add us as a payee, simply search for 'Municipal District of Taber' in your banking system, or reach out to your bank or financial institution for more information.

Please note

The Payee ID for payments made to the Municipal District of Taber through your financial institution may appear in the following format:

| Financial Institution | Payee ID/Biller ID Name Appears As | Payee ID/Biller ID # |

|---|---|---|

| ATB Financial | Municipal District of Taber | |

| RBC | Taber (Municipal District) - Prop Tx | 009002 |

| Scotiabank | Municipal District Taber Taxes | 0569 |

| Credit Union | Taber, Munic Dist | 3377 |

| CIBC | Taber (Municipal District) Tax | 6473 |

| Bank of Montreal | Taber Municipal District | 22009575 |

| TD Trust | Taber (Municipal District of) taxes | 8459 |

Since some accounts can only accept a 10-digit number, please enter 0(s) (zeros) before your account number to complete the sequence.